south dakota property tax abatement

1 COUNTY AUDITOR OFFICE Print Document. A website link to the application for each program is available on the Planning Division website.

Property Tax South Dakota Department Of Revenue

Or call the Property Information Center at 651-438-4576.

. Section 10-18-1 - Invalid or erroneous assessment or tax-Claims for abatement or refund-Certificate outstanding on real property sold for taxes Section 10-18-2 - Compromise abatement or rebate of uncollectible tax-Circumstances in which authorized-Apportionment among funds and taxing districts. To 5 pm Monday - Friday. That may well be the strongest property tax.

South Dakota property tax credit. You can download or print current or past-year PDFs of Form 24775 directly from TaxFormFinder. Property Tax Abatement And Refunds 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund--Certificate outstanding on real property sold for taxes.

North Sioux City offers a 5 year property tax abatement providing a graduate property tax liability to help you get your business off the ground. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax SDCL 10-4-42 to 10-4-45. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Email the Treasurers Office. Specific programs include no corporate income tax property tax abatement and energy and fuel conservation measures. Eligible waterways are determined by the Department of Agriculture and Natural Resources with additional waterways as allowed by the county commission.

The first 50000 or 70 of the assessed value of the property used for producing solar power ie your home whichever is greater is exempt from property taxes for four years. South Dakota Department of Revenue. Please check that you agree before.

You can print other North Dakota tax forms here. If you do NOT know which county your property is located in please use the link below to identify the county name. A proposal to alter the text of a pending bill or other measure by striking out some of it by inserting new language or bothBefore an amendment becomes part of the measure thelegislature must agree to it.

Please notate ID wishing to pay. Plains South Dakota South Dakota Basic Business Taxes 2010 South Dakotas economic development finance and tax organizations provide a range of incentive programs to initiate new business and commercial investment. A Fireside Chat With Jared Walczak Of The Tax Foundation Salt Shaker Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation Property Tax.

South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709. Look up your tax statement For manufactured homes go to the Manufactured Home Tax Statement and enter the 11-digit property identification number.

For more information on whether or not your property qualifies please contact Dustin Powers at 605-367-8897 in the Planning Division. You can also call the Property Information Center at 651-438-4576. Thank you so much for your assistance regarding the process to request a tax abatement for the real property located at 320 Cleveland St Rapid City SD and owned by Lighthouse Partnership Inc a South Dakota non-profit corporation.

Tax Abatement Application - Lighthouse Partnership Inc. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. North Sioux City offers a 5 year property tax abatement providing a graduate property tax liability to help you get your business off the ground.

Thank you - South Dakota Property Tax Division. This form requires county information for the property you own. South Dakota then takes it one dramatic step farther.

We last updated the Property Tax Application for Abatement or Refund in February 2022 so this is the latest version of Form 24775 fully updated for tax year 2021. Compare your state and others to South Dakota to see how you can keep more of your hard earned money by locating in South Dakota. South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive.

Click Property Tax Statement. December 2017 with the Commission for an abatement of its taxes for the 2014 and 2015 tax years citing SDCL 10-18-13 which authorizes a county commission to abate a tax if the property is exempt. 104 N Main Street.

2021 South Dakota Codified Laws Title 10 - Taxation Chapter 18 - Property Tax Abatement And Refunds Section 10-18-1 - Invalid or erroneous assessment or tax--Claims for abatement or refund--Certificate outstanding on real property sold for taxes. Terms Used In South Dakota Codified Laws Title 10 Chapter 18 - Property Tax Abatement and Refunds. PropTaxInstatesdus 445 E Capitol Ave Pierre SD 57501 USA 605 773-3311 Document Signers.

1 The board may abate any or all of the delinquent taxes and penalty on real property if taxes remain unpaid and the property has been offered for sale as required by the code for two successive years and not sold because of depreciation in the value of the property or otherwise or if any property has been bid in by the county and one year has elapsed since the bid. 2012 South Dakota Codified Laws Title 10 TAXATION Chapter 18. To protect your privacy this site uses a security certificate for secure and confidential communications.

Welcome to a Property Tax Electronic Form. South dakota property tax abatement Friday February 25 2022 Edit. That may well be the strongest property tax exemption weve seen in the country.

The City of Sioux Falls has three different property tax abatement programs. Tax Abatement Supporting Documentation 2. 10-18-11 Time allowed for abatement or refund of invalid inequitable or unjust tax.

South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes collected. CLICK HERE TO SEARCH YOUR COUNTY.

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

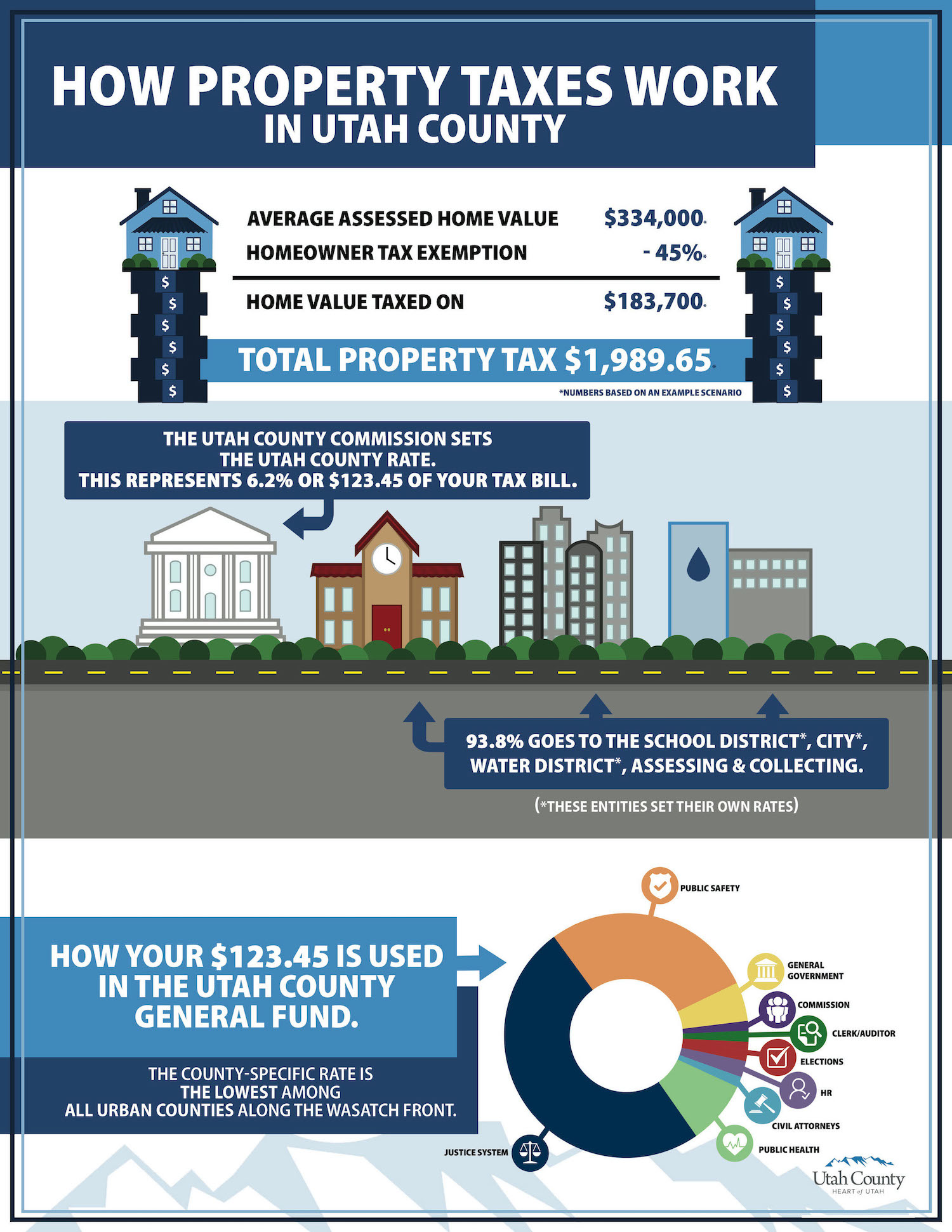

Utah County Property Tax Increase On The Horizon Lehi Free Press

What Is The Result From Red Sates Having Lower Taxes For Property And Purchases In General Quora

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Property Tax Comparison By State For Cross State Businesses

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Relief Programs South Dakota Department Of Revenue

Covid 19 Property Tax Relief Opportunities Salt Shaker

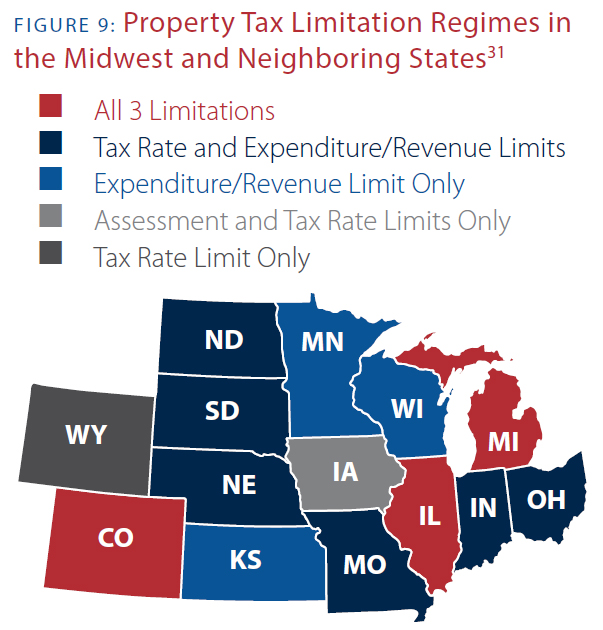

Get Real About Property Taxes 2nd Edition

Solar Property Tax Exemptions Explained Energysage

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Get Real About Property Taxes 2nd Edition

9 States Without An Income Tax Income Tax Income Tax

Property Tax South Dakota Department Of Revenue

Maine Dor Sales Use Tax Internet Filing Tax Quickbooks Internet

Property Tax South Dakota Department Of Revenue

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons